How Can Remittance Services be Leveraged to Promote Financial Inclusion and Economic Development in Developing Countries?

Introduction:

Remittance services play a crucial role in the financial landscape of developing countries, serving as a lifeline for millions of migrant workers and their families. These services facilitate the transfer of funds from migrants working abroad to their home countries, providing a significant source of income and contributing to economic development.

This article explores the potential of remittance services to promote financial inclusion and economic development in developing countries. It examines the scale and impact of remittances, the benefits of remittances for financial inclusion, the role of remittances as a catalyst for economic development, challenges and opportunities in leveraging remittances, case studies and best practices, and recommendations for policymakers and practitioners.

Benefits Of Remittances For Financial Inclusion:

- Remittances can serve as an entry point to formal financial services for migrants and their families, who may otherwise be excluded from traditional banking systems.

- Remittance service providers can play a vital role in expanding access to financial accounts, offering convenient and affordable money transfer services.

- Successful initiatives have linked remittances to financial inclusion, such as providing financial literacy training to migrants and their families, and offering remittance-linked savings and credit products.

Remittances As A Catalyst For Economic Development:

- Remittances can boost economic growth and poverty reduction by providing a steady flow of foreign exchange, increasing household incomes, and stimulating local economies.

- The multiplier effect of remittances can generate additional economic activity, as recipients invest in consumption, education, healthcare, and small businesses.

- Remittances can fund small businesses and entrepreneurship, creating jobs and fostering economic diversification.

Challenges And Opportunities In Leveraging Remittances:

- Barriers to effective utilization of remittances include high transaction costs, limited access to financial services, and lack of financial literacy.

- Regulatory frameworks and policies need to be supportive of remittance services, ensuring transparency, efficiency, and consumer protection.

- Collaboration between governments, financial institutions, and remittance service providers can enhance the impact of remittances on financial inclusion and economic development.

Case Studies And Best Practices:

- Mexico: The Mexican government has implemented a range of initiatives to leverage remittances for financial inclusion, including providing financial education to migrants and their families, and offering remittance-linked savings and credit products.

- Philippines: The Philippine government has partnered with remittance service providers to offer financial services to overseas Filipino workers, including mobile money accounts and remittance-linked insurance products.

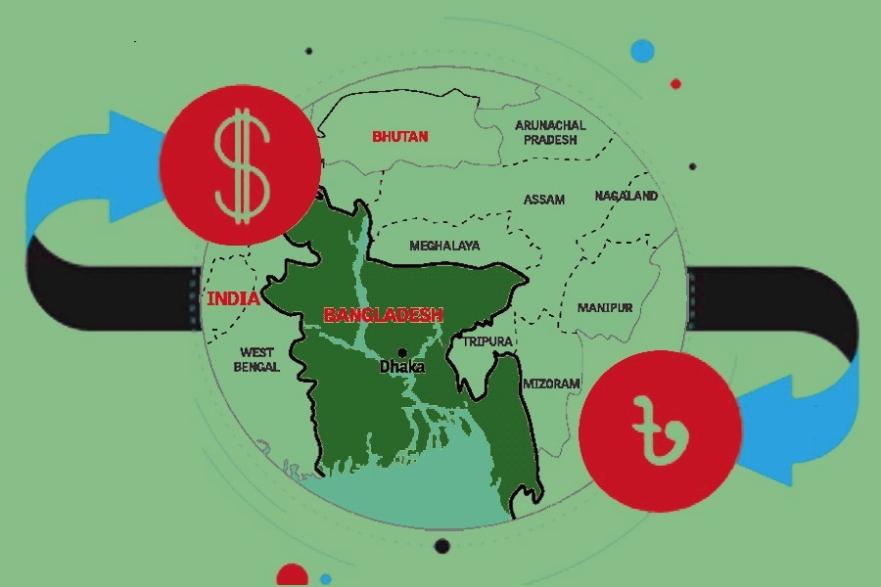

- Bangladesh: The Bangladesh government has established a dedicated remittance fund to support microfinance institutions and small businesses, channeling remittances into productive investments.

Recommendations For Policymakers And Practitioners:

- Policymakers should implement regulatory frameworks that support remittance services, reduce transaction costs, and promote financial inclusion.

- Financial institutions and remittance service providers should collaborate to develop innovative remittance products and services that meet the needs of migrants and their families.

- Governments and international organizations should invest in research and data collection to inform policymaking and improve the effectiveness of remittance services.

Remittance services have the potential to be a powerful tool for promoting financial inclusion and economic development in developing countries. By addressing the challenges and leveraging the opportunities, policymakers and practitioners can harness the positive impact of remittances to improve the lives of migrants and their families, and contribute to sustainable economic growth.

YesNo

Leave a Reply